What Does Buying a Car & Applying for Financial Aid for College Have In Common?

Financial Aid 101

What does buying a car & applying for college financial aid have in common?

Answer: The total cost you pay is negotiable!

This is the dirty little secret college don't want you to know!

So your child got accepted to college and the school even gave you financial aid! That's great!

But unfortunately, the amount they offered you wasn't enough, and you are worried that you won't be able to send your child off to college. I bet you didn't know is that you can appeal your offer and get more money!

Here's why all college students should appeal your financial aid offer.

Cars & Colleges Have a Negotiable Sticker Price

If you have ever bought a new car from a dealer, you may have encountered the term Manufacturer's Suggested Retail Price ( the MSRP is also known as the sticker price).

Carmakers set the MSRP to help separate you from your money, keeping more profit for the car dealer. And f you have ever bought a new car, you know you should NEVER pay the MSRP.

Many people hate buying a new car because they often feel the dealership took advantage of them. Car dealers use so many different gimmicks to distract you from several hidden costs that drive up your cost and increase their profit.

I'm saddened to say that colleges also have many hidden costs (I should know, I have one child in college).

A few of colleges' hidden costs:

- books

- student fees

- technology fees

- health center fees

- study activity fees

- transcript & graduation fees

- dorm increases based on location/newness of buildings

The list goes on and is also evident in the front-loading of grants before future tuition hikes.

Colleges are, first and foremost, a business. A very big business.

Still don't believe me? Take a look at how colleges profited during the pandemic!

We do not think of colleges that way because we think of them as socially responsible organizations. Because they are held in much higher esteem, people simply accept what the college "gives" them.

And this is where people make a mistake.

Why Colleges "Discount" Tuition

Colleges often give discounts to make the school seem more attractive and give you a reason to attend.

They need to be competitive with their "sale price" to get you to "shop" there. So why not offer students multiple incentives to attend your school? It's a win-win situation!

When colleges discount the sticker price, they can:

- make the school appear more "exclusive" with a high initial sticker price but still priced competitively after the "discount."

- offer "scholarships" tied to academics (which helps keep grades high).

- make students feel special because they are on a "scholarship."

The system works for colleges because most students take what is given.

But, the price you pay can be lowered, either through reducing the sticker price or through different forms of financial aid.

While the college classifies it differently, you don't care because you ultimately pay less.

The Financial Aid Formula

COA - EFC = FN

That jumbled mess of alphabet soup is what you need to learn to "play" the financial aid game.

Spelled out, that formula reads:

Cost of Attendance - Expected Family Contribution = Financial Need

Let's break it down.

COA = Cost of Attendance

This is:

- tuition & fees

- room & board

- books, supplies, travel, and other miscellaneous expenses.

EFC = Expected Family Contribution

Colleges use your Free Application for Federal Student Aid (FAFSA) form to calculate the amount you are expected to pay.

Things considered:

- savings/investments

- income (verified by the IRS)

- other kids in college (this might be changing in 2022)

FN = Financial Need

In simple terms, they take the cost to attend the college, subtract how much you can pay, and this is the financial need you "should" get.

Unfortunately, you don't always get all the aid you need.

That missing amount is the gap you are expected to come up with.

For example:

Cost of Attendance (COA) =$20k/yr - (this is the cost of college)

Expected Family Contribution (EFC) = $10K/yr - (this is the amount the college expects you to pay)

Financial Need (FN) = $10K/yr - (in order to send your student to college, you will need another $10K per year).

But let us say the college only gives you $5,000 in financial aid. That leaves a gap of $5,000 per year that you have to pay for yourself.

Despite what you say and how little money you have available for college (and life), the college has decided you need to prove how much you want to study at their college by asking you for more money.

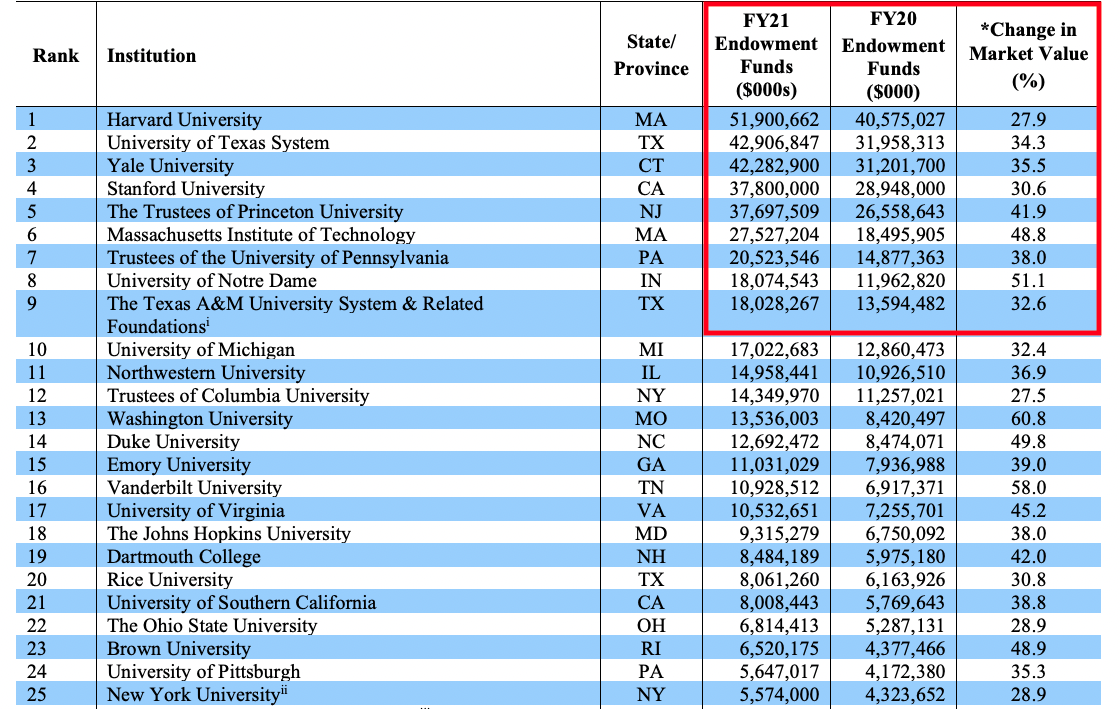

If that has not made you mad yet, remember that the Princeton, Yale, and University of Texas System all increased the value of their endowments by over $30 million a day last year.

$30 Million per day!

How to Reduce Your Total Tuition Cost

Colleges aren't all bad. They offer you a way to close the gap through "non-need-based aid."

Students and families have the option:

- work more

- take federal loans

- apply for scholarships

- take school-based loans

- take private loans (most expensive of all options)

- agree to tuition payment plans (colleges become the lender)

- Request a reevaluation of your circumstances (this is what we want to do first!)

Reevaluating our Financial Need and Gap

Colleges are not required to reevaluate or consider special circumstances, but you may request a process called "professional judgment."

What Does the Movie Fight Club and College Financial Aid Have In Common?

Remember how the characters in the movie Fight Club weren't allowed to talk about Fight Club?

Well, when you negotiate with colleges, don't ask to negotiate!

In reality, you are dealing with "objective criteria," and according to the universities, these are non-negotiable.

Colleges are so pure, aren't they?

Two Categories of Financial Aid

The mistake many parents make when dealing with financial aid is going to the wrong office:

- if you have a student with excellent grades and test scores, turn to the admissions office for money.

- contact the financial aid office if you need more for college and can not afford as much.

How To Appeal for Financial Aid

When you appeal, be honest and direct with your needs. List unreimbursed medical expenses, K-12 tuition for siblings, unusual capital gains, job loss, pandemic losses, etc. Explain that the amount they have calculated and the gap you need to overcome will put too great of a financial burden on you.

Don't feel bad for colleges when asking for help.

They often have huge endowments and budgets in the millions and even billions!

Here's a list of the endowments and operating budgets of Ivy League colleges

Again, don't feel bad about asking for a little something from the top. The universities can afford it more than you!

If you spent a few hours writing the appeal & you got an extra $5,000, I'd say it was worth it.

Letter of Appeal and Required Forms

There are some steps you need to take to appeal your financial aid offer:

- talk to your college financial aid counselor and explain your situation. He or she may be able to help you resolve the issue without having to file an appeal.

- if you need to file an appeal, the next step is to complete the required paperwork. You can get this information from your financial aid office.

- once you have completed the paperwork, submit it to the financial aid office along with the appropriate supporting documentation. They will review your case and decide whether or not to increase your financial aid award.

Get Outside Help If You Need It

If you don't want to tackle this yourself, some companies specialize in helping you.

These companies take a fee, but 50% of something is better than 100% of nothing!

As with so many things, do your research carefully and look for references before trusting anyone with something this important.

FAQs

What Are Good Reasons to Appeal for Financial Aid?

- You are having a hard time paying your tuition.

- You failed to get the scholarship that you wanted.

- You are having a difficult time getting as much financial from family or friends.

The most important reason for applying for financial aid is that you need the money. As the cost of college skyrockets, more and more students need financial assistance. If you find yourself in this situation, don't be afraid to ask for help. There are many options for financial aid, and applying can help you get the money you need to attend college.

Another good reason to apply for financial aid is if circumstances in your family have changed. Perhaps your parent has lost their job or suffered a medical emergency. In this case, your family may not be able to provide the same level of support as before. I

Should You Appeal Your Financial Aid Offer

Colleges receive requests and appeals for financial aid awards year-round. Most colleges even have a staff member whose sole job is to help families appeal.

Please review it carefully and understand all the components when receiving your financial aid offer. If you feel the offer is not fair or reasonable, you can appeal. The process is relatively simple, and it can not hurt to ask for more assistance.

Most colleges are even willing to work with families to ensure they get the best education possible at an affordable price.

Can You Appeal Your Financial Aid Offer

Yes, you can appeal your financial offer aid offer if you feel that the amount offered is not sufficient.

The best way to appeal is to gather all your income and expenses documentation. This may include pay stubs, bank statements, mortgage or rent statements, or other documentation that can support your case.

You can then submit an online appeal form or send a letter to the Financial Aid Office detailing your situation and why you believe you should receive a higher award. Be sure to include any additional information that might be helpful, such as letters from employers or other supporting documents.

Remember, appeals are not always successful, but it's worth trying.

How Long Does It Take To Appeal Your Financial Aid Offer?

The period may vary depending on the school but should generally be between two and six weeks.

Each school has its own process and timeline for reviewing financial aid offers and appeals, so it is important to check directly with the school to determine how long it will take. Generally, most schools require that you submit your appeal in writing and provide the appropriate documentation.

It is also essential to know that appealing your financial aid offer is not always a guarantee of success. The school may still not increase your grant or may increase it only slightly. However, it is worth trying if you feel you have been treated unfairly or if circumstances in your family have changed unexpectedly.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.